Two years ago, 22,000 festival goers in England unknowingly agreed to clean public toilets and scrape chewing gum off the streets by ignoring the terms and conditions when signing up to two weeks of free Wi-Fi.

These individuals are hardly the exception to the rule, chances are you’ve also skipped right past the terms and conditions when entering a new phone contract, upgrading phone or computer software, setting up a bank account or in countless other situations, keen to complete the deal and sign your name on the dotted line.

You wouldn’t be the first to ignore all the warranties, disclaimers and special clauses that accompany so many products and services these days, and you certainly won’t be the last.

The world of investment and personal finance is no different. There are more pages than ever that hold important, and often legal, information about the specifics of financial products and services.

While we should all take care to understand the implications of our investment and personal finance decisions, how many of us can honestly say that we read through each page and took the time to decipher and understand the fine print?

Now, while skimming the Ts&Cs of an investment product disclosure statement is unlikely to wind up with you cleaning toilets, amongst the important information that can help inform your decisions, there is also one of the most valuable lines of financial wisdom:

‘Past performance is not an indication of future performance.’

If you’ve read the disclosure statement at the bottom of any Smart Investing article, or any financial document for that matter, you may have already spotted it.

At Vanguard, we often talk about how a sound investment strategy starts with an asset allocation suitable for the portfolio’s objective, and just as important as the combination of assets that are used to construct a portfolio, are the assumptions that are used to arrive at the asset allocation decision. By this we mean using realistic expectations for both returns and volatility of returns.

While this is sound portfolio construction advice, it doesn’t remove the temptation to be led by the recent performance of any given asset class. The challenge that comes with that is it is almost impossible to select the asset class that is going to be next year’s winner.

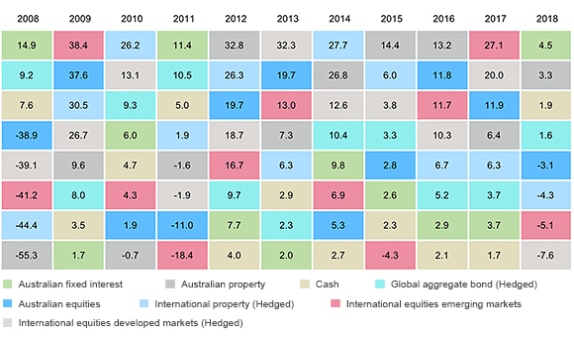

Annual asset class return for the year ended December 2018

Source: Vanguard Investment Strategy Group analysis using index data from Bloomberg, Barclays, FTSE, MSCI, S&P & UBS.

Notes: Australian equities is the S&P/ASX 300 Index; Australian Property is the S&P/ASX 300 A-REIT Index; International Property Hedged = FTSE EPRA/NAREIT Dev x Au Hedged into $A from 2013 and UBS Global Investors ex Australia AUD hedged Index proir to this; International Shares Hedged is the MSCI World ex-Australia Index Hedged into $A; Emerging Markets Shares is the MSCI Emerging Markets Index; Australian Bonds is the Bloomberg Ausbond Composite Bond Index; Global Aggregate Bonds = Bloomberg Barclays Global Aggregate Index Hedged into $A; Cash = Bloomberg AusBond Bank Bill Index.

If you had looked at the performance of International Equities in 2017 and on that basis switched your portfolio to overweight that asset class, you may have been sorely disappointed – at least in the short term – at the end of 2018 to see it finish second last.

The same way as if you had of avoided Australian Fixed Interest because of its low performance in 2016 and 2017, you would have missed out on it being a strong performer – and more importantly a diversifier of risk – in 2018.

The chart above may look like a patchwork quilt of colours but the randomness of the best and worst performance results illustrates the point that short-term past performance is both hard to get right and not a reliable predictor of future performance.

Indeed if you use it to drive your portfolio construction decisions you are likely to find yourself buying in at the top of a particular cycle only to ride it down as markets move.

The only real certainty is that performance leadership among market segments changes constantly over time, so it is important for investors to understand the role of diversification to both mitigate losses and to participate in gains. If you feel the need to alter your asset allocation when markets experience inevitable turbulence, it is worth taking heed of the wisdom found within the fine print.

By Robin Bowerman, Head of Corporate Affairs at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2019 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.